marin county property tax due dates 2021

Online or phone payments recommended by Tax Collector. Search For Title Tax Pre-Foreclosure Info Today.

Marin County Retail Properties Reel From Coronavirus Rules As Office Market Reawakens

Payment deadline for first half of property taxes is April 30 2021 and second half November 1 2021.

. Marin County taxpayers are being asked to pay online by phone or by mail rather than in-person. S Last day for the county treasurer to make full settlement with the county auditor of all property taxes and other taxes and service charges on the property tax statements collected since the last day mentioned in the May 20 settlement of the preceding year through December 31 of the preceding year. Searching Up-To-Date Property Records By County Just Got Easier.

This years tax roll of 1262606363 is up. The first installment is due November 1 and must be paid on or before December 10 to avoid penalty. Offered by County of Marin California.

April 01 2022 Second Installment of Property Taxes Due Monday April 11 is the last day to pay without penalty San Rafael CA Monday April 11 is the last day for property owners to pay the second installment of their. Mina Martinovich Marins interim director of. On January 1 preceding the fiscal year for which property taxes are collected.

San Rafael CA Marin Countys 2021. The median property tax paid by homeowners in the Bay Areas Contra Costa County is 4941 per year. September 28 2021 at 411 pm.

25 according to the county. The first installment is due Nov. Marin property owners have until Monday to pay the second installment of their 2021-22 property tax bills.

1 and must be paid on or before Dec. The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 126 billion up 319 over. Main Office McPherson Complex 503 SE 25th Avenue Ocala Florida 34471 352 368-8200.

Taxpayers are being asked to pay online by phone or by mail rather than in person at the Marin County. Our mailing address is Marin County Assessor PO Box C San Rafael CA 94913. Current property tax due dates are.

MARIN COUNTY CA Marin Countys 2020-21 property tax bills have been sent to property owners. However Senate Bill 219 signed by Gov. The median property tax in Marin County California is 5500 per year for a home worth the median value of 868000.

Assessment date for both real and personal property. Marin County has one of the highest median property taxes in the United States and is ranked 26th of the 3143 counties in. Marin County collects on average 063 of a propertys assessed fair market value as property tax.

The 2020-2021 tax roll amounted to 122 billion up 573 over the previous year. Local property tax revenues are needed now more than ever. Ad Find Marin County Online Property Taxes Info From 2021.

San Rafael CA The second installment of the 2020-2021 property taxes becomes delinquent at 5 pm. See Property Records Tax Titles Owner Info More. The time when the taxes become a lien on property and the time property is valued for tax purposes.

276111 Timely if done the next succeeding day. Taxes on unsecured roll are due on the lien date. Establishing tax levies estimating property worth and then receiving the tax.

Property owners who do not receive a tax bill by mid-October especially those who have recently purchased real estate in Marin should email or call the Tax Collectors Office at 415 473-6133. Search Any Address 2. The Tax Collectors office is in Suite 202 of the Marin County Civic Center 3501 Civic Center Drive San Rafael.

The Marin County Department of Finance has mailed out 91854 property tax bills for. The County of Marin Department of Finance makes every effort to share all pertinent parcel tax exemption information with the public. Normally the property tax bills are payable in two.

If you have questions about the following information please contact the Property Tax Division at 415 473-6168. The first installment is due November 1 and must be paid on or before December 10 to avoid penalty. Monday April 12 a date not expected to change due to the COVID-19 pandemic.

Ad Be Your Own Property Detective. The median property tax on a 86800000 house is 642320 in California. September 27 2021 at 642 pm.

Dance degas lesson wallpaper. The Marin County Department of Finance has mailed out 91854 property tax bills for a 2021-22 tax roll of 126 billion up. Marin Countys 91184 tax bills were mailed on Friday.

Property tax bills are mailed annually in late September and are payable in two installments. Assessment date for both real and personal property. MARIN COUNTY CA Marin Countys 2020-21 property tax bills have been sent to property owners.

Office hours are 9 am. Ad Find Marin County Online Property Taxes Info From 2021. Marin county property tax due dates 2021.

The hours for the Tax Collectors office and express payment drop box are 9 am. Overall there are three stages to real estate taxation. Marin county property tax due dates 2021.

10 to avoid penalty. The second installment must be paid by April 10 2021. Last day to file for tax-exempt status with the assessor.

Online or phone payments recommended by Tax Collector. A total of 91184 property tax bills were mailed Sept. Taxing units include city county governments and various special districts such as public schools.

San Rafael CA The first installment of the 2021-2022 property taxes becomes delinquent at 5 pm. Lien Date - 1201 am. On April 9 and 8 am.

If you pay your property taxes yourself rather than through a mortgage lender you should receive your statement by March 1 2021. MARIN COUNTY CA Marin Countys 2020-21 property tax bills have been sent to property owners. Last day for county treasurers to mail Property Tax.

Delinquent date stated on bill. They all are legal governing units managed by elected or appointed officers.

221 Marin County Apartments Change Hands In 188 Million Of Deals

Measure To Extend Marin County Parks Tax Won T Appear On Recall Election Ballot Local News Matters

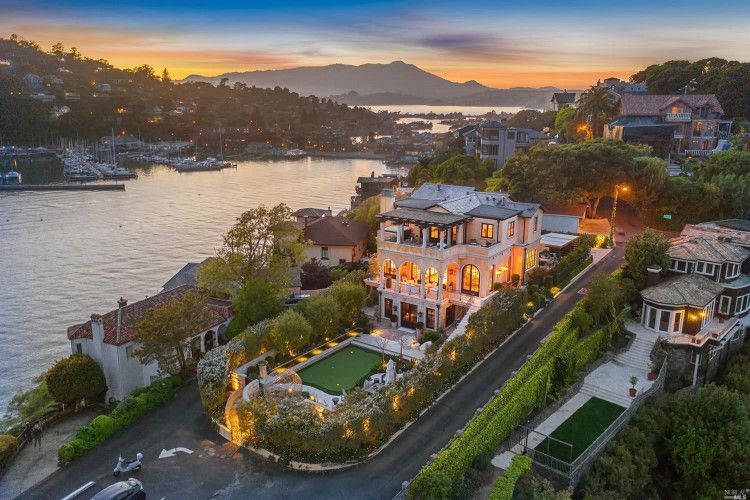

6 Marin County Properties With Staggering 25m Price Tags Have Come On The Market In The Past Few Months

![]()

Pandemic May Excuse Late Payment Of Due Marin Property Tax

Property Taxes Page 2 Marin Independent Journal

Marin Economic Forum Did You Know Marin Economic Forum

George Russell Marin Residents Face Another Property Tax Deadline Marin Independent Journal

Editorial Consider Impacts Of Reactions To West Marin Vacation Rentals Ban Marin Independent Journal

Cheech Marin S Personal Collection Of Chicano Art Opening To Public In Riverside California

Marin Lodge Updated 2022 Prices Reviews Photos San Rafael Ca Motel Tripadvisor

Michael Frost Assistant Director Of Public Works County Of Marin Linkedin